A consistent problem with Time Series Analysis is its assumption of static drivers - that is, the internal makeup of the total remains constant over time.

If we take the example of airline tickets - there was a considerable reduction in cost over the period being examined, which meant that the percentage of business to leisure tickets was changing. In other words, there were two quite different drivers being summed to determine the overall market. If these two components were studied separately, then two very different trends would have emerged. The airline ticket changes took place at least relatively slowly in comparison with twelve months seasonality, except that the leisure trips tend to be concentrated where the business trips were least (Christmas, say), so the shape of the seasonality also changes.

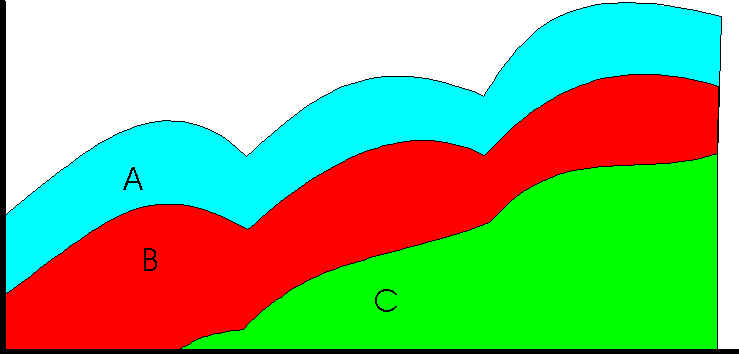

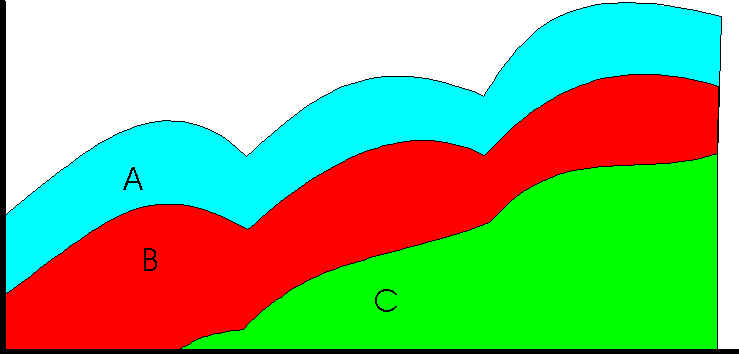

Here is an actual example of the introduction of a new biscuit into a market where it rapidly achieves dominance, and has a different seasonality to the products whose market it cannibalises.

Extraction of a useful total envelope with which to make predictions is bound to fail - far better to analyse the market in detail, then put the components together. This is much easier to do in a knowledge-rich environment, where analysis is taking place at every level, and where each level can interact with any of the others - a constraint on the total affects the components, and interaction among the components is easily described or learnt from the data.